shirunov.ru

Community

Backend Training

Back-End Developer Job Profile. Become a Back-End Developer by learning skills from MAHARA-TECH, then get a completion certificate to validate your skills. A comprehensive immersive learning Bootcamp for career advancement in technology. Build and deploy sophisticated backend apps and services from the ground up. Level up your JavaScript by learning how to implement classes, modules, and error handling. Professional certification available with Pro. Pass all exams to. Master Java for web development with Udacity's Java Developer Course. Gain hands-on experience in enterprise back-end tech. Advance your career. In the Back End Development and APIs Certification, you'll learn how to write back end apps with shirunov.ru and npm. You'll also build web applications with the. with JavaScript. Learn how to build back-end web APIs using shirunov.ru, shirunov.ru, SQL, and a shirunov.ru-SQLite database library. Includes 8 Courses. With. Learn everything about backend web development: Golang, Postgres, Redis, Gin, gRPC, Docker, Kubernetes, AWS, CI/CD. A Backend Engineering course that shows you exactly how to level up your backend engineeing skills, step-by-step. This is a beginner course intended for learners eager to learn the fundamentals of web development. To succeed in this course, you do not need prior web. Back-End Developer Job Profile. Become a Back-End Developer by learning skills from MAHARA-TECH, then get a completion certificate to validate your skills. A comprehensive immersive learning Bootcamp for career advancement in technology. Build and deploy sophisticated backend apps and services from the ground up. Level up your JavaScript by learning how to implement classes, modules, and error handling. Professional certification available with Pro. Pass all exams to. Master Java for web development with Udacity's Java Developer Course. Gain hands-on experience in enterprise back-end tech. Advance your career. In the Back End Development and APIs Certification, you'll learn how to write back end apps with shirunov.ru and npm. You'll also build web applications with the. with JavaScript. Learn how to build back-end web APIs using shirunov.ru, shirunov.ru, SQL, and a shirunov.ru-SQLite database library. Includes 8 Courses. With. Learn everything about backend web development: Golang, Postgres, Redis, Gin, gRPC, Docker, Kubernetes, AWS, CI/CD. A Backend Engineering course that shows you exactly how to level up your backend engineeing skills, step-by-step. This is a beginner course intended for learners eager to learn the fundamentals of web development. To succeed in this course, you do not need prior web.

You can find the number of questions, the duration of the exam, what areas you will be tested on, and recommended course work and content you can reference. The cost of learning back end web development can range from $2, to $60, depending on the type of program, with four-year degree programs on the higher. Backend Engineering Interview Preparation Course - Master backend engineering to get job at FAANG+ companies for Backend engineer. Get training to excel. Back-end developer career path · 1. Learn Python · 2. Learn Shells and Terminals · 3. Learn Git · 4. Build a Bookbot · 5. Learn Object Oriented Programming · 6. Meta offers a really good backend proffesional certificate course on a site called coursera. Prepare for a career in Back-end Development. Receive professional-level training from Meta; Demonstrate your proficiency in portfolio-ready projects. Most bootcamps run a Full Stack Software Developer program, but we found that it's better to specialize in Front End, Back End, or Data Engineering. Because of. Courses to get you started · Most popular · Backend Master Class [Golang + Postgres + Kubernetes + gRPC] · Fundamentals of Backend Engineering · Build a Backend. A 3-day, instructor-led (classroom and virtual) Java based course specifically designed for back-end developers to build and deploy AEM websites. Learn to become a Front-End Developer or Back-End Developer in just a few months with our online career training programs, hosted on Coursera. We're not a $10, bootcamp. We're not a $50, university degree. We are a self-paced, gamified online learning platform for back-end web development. You. learning backend development, basically from scratch. I have programming knowledge, but I want to be a backend developer, and it seems there. Backend development is the backbone of web applications, responsible for creating the server-side logic that enables seamless functioning. To thrive in this. Frontend developers also learn several frontend frameworks and know how to conduct performance optimization. Backend developers code application functions and. Module 4 serves as the capstone where students are pushed to specialize their skillset by learning more about React, SQL and Databases, Rails and Back End. Your path to start your journey in becoming a developer · Learn C# · Web Apps · Backend APIs and Microservices · Mobile & Desktop Apps. Course Outline. In this video, you'll learn how to build the backend integration. This video is from the Nuxeo Connector course. Sign-In Don't have a Hyland. Abacus Backend Training Series. A series of videos help you get started and refresh your knowledge. There are only handful of ways clients communicate with backend applications, although they might be more, I believe the patterns I discuss in this course are. In this week, Back End Software Development program, students take three courses to learn the skills and technologies necessary to enter the industry as a.

Vietnam Etf In Us

Top 27 ETFS with Viet Nam Exposure ; AVEE - AMERICAN CENTURY ETF TRUST - Avantis Emerging Markets Small Cap Equity ETF · American Century ETF Trust - American. Rethinking the TPP Without the U.S.. July 22, a.m. ET. Three Funds That Will Ride Vietnam's Growth. April 22, a.m. The Global X MSCI Vietnam ETF (VNAM) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses. Commission-free trading refers to $0 commissions charged on trades of US listed registered securities placed during the US Markets Regular Trading Hours in self. VanEck was founded in by John van Eck to offer investment alternatives to the U.S. equity and fixed income markets. Recognizing the potential for value in. VNM, the largest and most liquid U.S. - listed Vietnam ETF provides investors one trade access to the Vietnamese market. To receive more Emerging Markets. The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MarketVector Vietnam Local Index. Stay on top of the latest data on Equity, Commodity, Currency, Bond or Other ETFs in Vietnam USA ETFs. Look into Bill Gates' portfolio to find hidden gems. VanEck Vietnam ETF is an exchange traded fund incorporated in the USA. The Fund- 's objective is to replicate as closely as possible the price and yield. Top 27 ETFS with Viet Nam Exposure ; AVEE - AMERICAN CENTURY ETF TRUST - Avantis Emerging Markets Small Cap Equity ETF · American Century ETF Trust - American. Rethinking the TPP Without the U.S.. July 22, a.m. ET. Three Funds That Will Ride Vietnam's Growth. April 22, a.m. The Global X MSCI Vietnam ETF (VNAM) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses. Commission-free trading refers to $0 commissions charged on trades of US listed registered securities placed during the US Markets Regular Trading Hours in self. VanEck was founded in by John van Eck to offer investment alternatives to the U.S. equity and fixed income markets. Recognizing the potential for value in. VNM, the largest and most liquid U.S. - listed Vietnam ETF provides investors one trade access to the Vietnamese market. To receive more Emerging Markets. The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MarketVector Vietnam Local Index. Stay on top of the latest data on Equity, Commodity, Currency, Bond or Other ETFs in Vietnam USA ETFs. Look into Bill Gates' portfolio to find hidden gems. VanEck Vietnam ETF is an exchange traded fund incorporated in the USA. The Fund- 's objective is to replicate as closely as possible the price and yield.

VanEck Vietnam ETF · Asia Pacific Equities, %, %. «First; ‹ Prev; 1 Us · Terms of Use and Privacy Policy; © VettaFi LLC. All rights reserved. The iShares MSCI Emerging Markets Asia ETF seeks to track the investment results of an index composed of Asian emerging market equities. ETFs at Charles Schwab & Co., Inc. ("Schwab") which are U.S. exchange-listed can be traded without a commission on buy and sell transactions made online in a. Global X Funds - Global X MSCI Vietnam ETF was formed on December 7, and is domiciled in the United States. With 2 ETFs traded on the U.S. markets, Vietnam ETFs have total assets under management of $M. The average expense ratio is %. Vietnam ETFs can be. Vietnam stands as prime beneficiary of investment Analysis. Boris Schlossberg. Aug 05, U.S. Widening Trade Deficit a Boon for This ETF. The US trade. VanEck Vietnam ETF ; Price currency, USD ; Domicile, United States ; Symbol, VNM ; Manager & start date. Peter Liao. ; Non-US stock, %. Growth of 10, ; Percentile Rank, —, — ; # of Invest. in Cat. —, — ; categoryName, US Fund Miscellaneous Region, US Fund Miscellaneous Region ; Category Name. MQ. Get the LIVE share price of VanEck Vectors Vietnam ETF(VNM) and stock performance in one place to strengthen your trading strategy in US stocks. regulated by the U.S. Securities and Exchange Commission (SEC), Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS). Find the latest VanEck Vietnam ETF (VNM) stock quote, history, news and other vital information to help you with your stock trading and investing. VNM | A complete VanEck Vietnam ETF exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing. Get VanEck Vietnam ETF (VNM:CBOE) real-time stock quotes, news, price and Us. Please Contact Us · Privacy Policy; California Consumer Privacy Act (CCPA). ETF Creation and Redemption. About Us. Our Team · Our Events · Contact Us. This website is owned and managed by Premia Partners Company Limited ("Premia. The fund invests at least 80% of its total assets in the securities of the underlying index (typically denominated in local currency) and in American Depositary. Yes, Indian investors can buy VanEck Vectors Vietnam ETF (VNM) in the US stock market by opening an International Trading Account with Angel One. How to buy. This website is intended for residents of the United States. United States. Individual Investor. An easy way to get VanEck Vietnam ETF real-time prices. View live VNM stock fund chart, financials, and market news. Learn everything about VanEck Vietnam ETF (VNM). News, analyses, holdings, benchmarks, and quotes. View the latest VanEck Vietnam ETF (shirunov.ru) stock price and news, and other vital information for better exchange traded fund investing.

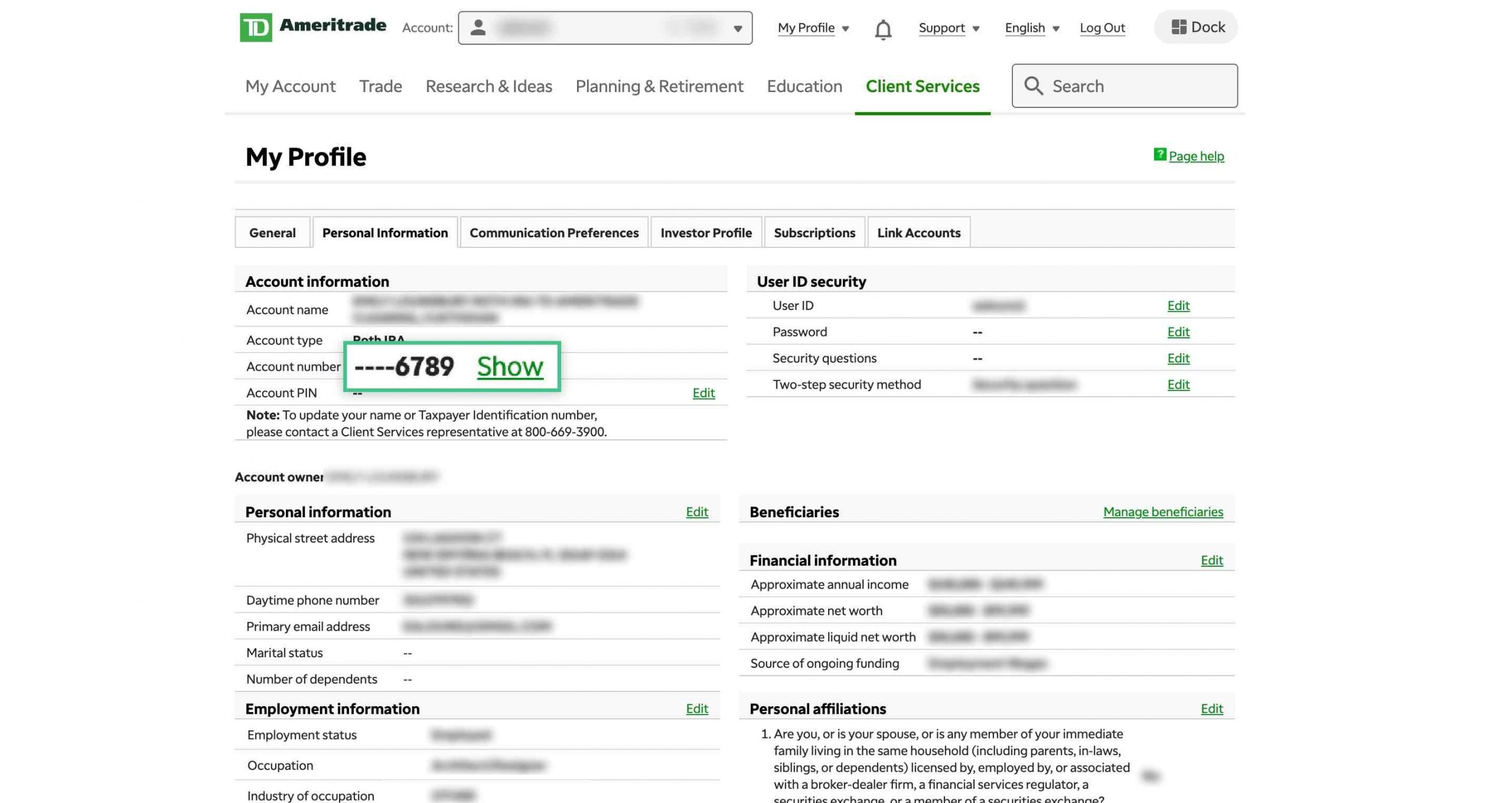

What Is My Td Ameritrade Account Number

your TD Ameritrade or Schwab Accounts. your checking account to send a payment to TD Ameritrade. Include your account number in the “account number” field. If you're a TD Ameritrade customer or are looking at transferring your account Once you've entered the TD Ameritrade's fax number, the final step is to. TD Ameritrade uses the following routing number to set up direct deposits into your TD Ameritrade account. TD Ameritrade Routing Number. See trending topics. Find answers to all your questions about transferring funds, opening an account and investing at Merrill. Transfer an account. In , TD Ameritrade was acquired by Charles Schwab Corporation. TD Ameritrade Holding Corporation. Former Corporate headquarters, in Omaha, Nebraska. Technician's Assistant: The Computer Expert can help you recover your account. Do you have an email address or phone number linked to it? Customer: ***@******. You will need to know your TD Ameritrade account number and your document ID. Your document ID will be located on your TD Ameritrade statement or Form Account Number/Fund Number: Fund Name: Transfer (Check one): N All Shares N Only the cash proceeds transferred to the Account with TD Ameritrade; the. Once your accounts are transitioned to Schwab, they will be assigned new 8-digit account numbers. All TD Ameritrade account numbers will no longer be valid. your TD Ameritrade or Schwab Accounts. your checking account to send a payment to TD Ameritrade. Include your account number in the “account number” field. If you're a TD Ameritrade customer or are looking at transferring your account Once you've entered the TD Ameritrade's fax number, the final step is to. TD Ameritrade uses the following routing number to set up direct deposits into your TD Ameritrade account. TD Ameritrade Routing Number. See trending topics. Find answers to all your questions about transferring funds, opening an account and investing at Merrill. Transfer an account. In , TD Ameritrade was acquired by Charles Schwab Corporation. TD Ameritrade Holding Corporation. Former Corporate headquarters, in Omaha, Nebraska. Technician's Assistant: The Computer Expert can help you recover your account. Do you have an email address or phone number linked to it? Customer: ***@******. You will need to know your TD Ameritrade account number and your document ID. Your document ID will be located on your TD Ameritrade statement or Form Account Number/Fund Number: Fund Name: Transfer (Check one): N All Shares N Only the cash proceeds transferred to the Account with TD Ameritrade; the. Once your accounts are transitioned to Schwab, they will be assigned new 8-digit account numbers. All TD Ameritrade account numbers will no longer be valid.

(As directed in Section 1 both registration and Tax IDs for the. TD Ameritrade account and account being transferred should match.) Account Number (Required): . 1. During the enrollment process, you will immediately receive your. TD Ameritrade account number and be asked to create your own personal identification number. Fill in your token number and click Submit. Voila! You have successfully transferred your money to your TD Ameritrade Account. You need to wait. Once you have collected these details, you can initiate the transfer process. It is crucial to have your account details handy, including your account number. Your account number is located to the right of the routing number at the bottom of your TD Bank check. You can also find this number on your statement, as well. your TD Ameritrade or Schwab Accounts. your checking account to send a payment to TD Ameritrade. Include your account number in the “account number” field. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer. The institution number for Toronto-Dominion Bank is An input form and bank card. the validation method (phone or text/SMS). If you don't have a User ID, please enter your account number and follow the on-screen prompts. A security code. Effortlessly manage your investments and access your TD Ameritrade account securely through the 'Ameritrade Login My Account' portal. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. All rights reserved. Used with permission. Personal. Once the account is opened,. TD Ameritrade will send you a. Welcome Kit that includes your brokerage account number and explains their brokerage account. 1) Account Handbook Keep this information handy. It’s your resource for details on investing and contacting TD Ameritrade when you need questions. Please note that you will need both your account number and. PIN to access securities in your TD Ameritrade SDBA and transfer the assets to your core account. Login Instructions · 1. Log into My Alerus. First-time users: · 2. Next, select a phone number and your preferred method of authentication (text or call). Ensure. Shopping for a personal installment loan? Checking loan options is quick, easy, and does not affect your credit score. Check your loan options today! We make it easy to transfer all or part of an account to Fidelity—including stocks, bonds, mutual funds, and other security types—without needing to sell your. A few items you will need is your TD Ameritrade account # and your zip code of the same social security number (Example: Husband & Wife), please fill out the. Set up an automatic payment to: · Address: PO Box Omaha, NE · Phone number: · Make the payment out to: TD Ameritrade · MAKE SURE YOU.

Best Home Insurance For Airbnb

CBIZ allows you to protect your investment with insurance coverage developed just for short-term vacation rentals. Its policy includes coverage for property. Hosts listing through Airbnb usually receive AirCover for Hosts free of charge. This generally includes up to $3 million in property coverage, and $1 million in. The hyper niche Proper Insurance policy is the best insurance for Airbnb hosts, delivering unmatched protection in the short-term vacation rental industry. The. Secure your NH Airbnb with the right insurance. Expert best Airbnb coverage options for property and liability protection. Allied Insurance Agency. Some home-sharing companies offer a form of coverage for hosts. For instance, Airbnb's Host Protection Insurance provides up to $1 million USD for liability. Airbnb Homeowners Insurance Information. You may be thinking about renting out an extra room in your home or maybe you have another property you are considering. Airbnb's revamped AirCover is free for hosts and typically provides up to $1 million of Airbnb liability coverage and $3 million of damage protection on your. The Best Insurance Options for Airbnb Hosts Compared ; Covers personal liability, X · ✓, ✓, ✓ ; Includes advanced guest screening (especially in areas with. The Best Airbnb Host Insurance in We compare some of the top short term rental insurance options on the market in this article. CBIZ allows you to protect your investment with insurance coverage developed just for short-term vacation rentals. Its policy includes coverage for property. Hosts listing through Airbnb usually receive AirCover for Hosts free of charge. This generally includes up to $3 million in property coverage, and $1 million in. The hyper niche Proper Insurance policy is the best insurance for Airbnb hosts, delivering unmatched protection in the short-term vacation rental industry. The. Secure your NH Airbnb with the right insurance. Expert best Airbnb coverage options for property and liability protection. Allied Insurance Agency. Some home-sharing companies offer a form of coverage for hosts. For instance, Airbnb's Host Protection Insurance provides up to $1 million USD for liability. Airbnb Homeowners Insurance Information. You may be thinking about renting out an extra room in your home or maybe you have another property you are considering. Airbnb's revamped AirCover is free for hosts and typically provides up to $1 million of Airbnb liability coverage and $3 million of damage protection on your. The Best Insurance Options for Airbnb Hosts Compared ; Covers personal liability, X · ✓, ✓, ✓ ; Includes advanced guest screening (especially in areas with. The Best Airbnb Host Insurance in We compare some of the top short term rental insurance options on the market in this article.

Airbnb provides insurance protection: AirCover for Hosts. Nevertheless, you must take every precaution to protect your property. Before posting your ad on a. You need insurance that covers Airbnb rentals above and beyond your homeowner's policy. Let us help make sure you're protected with home-sharing insurance. Talk. If you have a Vero home policy for the house you live in, and it is insured for Cover Option - Maxi (our highest level of cover), it will automatically be. best thing to do is call your insurance company to explain your situation and get a clear picture of your coverage. With belairdirect, in Quebec, the. The best insurance available to Airbnb hosts is Proper Insurance. They have the most comprehensive policy on the market that completely replaces a homeowners. The Berkshire Hathaway and Proper Insurance Short Term Vacation and Rental Insurance Policy for Homeowners using Airbnb and VRBO is the best on the market. Vrbo liability insurance offers $1 million in coverage to protect homeowners offering their property as a short-term rental, a coverage that may be excluded. Your regular homeowners policy typically won't cover commercial activities such as an airbnb. So let's say my patio cover falls due to neglect. Renting out a home is a business. The regular homeowner's policies do not cover risks such as Airbnb because a homeowners policy is written for owner-occupied. Does homeowners insurance cover Airbnb properties and short-term rentals? Probably not. Most standard homeowners insurance policies are designed to cover. Liberty Mutual is one of our top choices for renters insurance for landlords thanks to its focus on a self-service-based structure. Liberty Mutual has a. Host liability insurance: Airbnb Host Liability Insurance covers you if your guest gets injured. It also covers damage or theft of your guests property. You can. CBIZ vacation rental insurance is viewed as one of the best names in the vacation rental insurance industry. With coverage for both everyday hosts and property. To the extent you desire protection beyond the Airbnb Host Guarantee, Airbnb strongly encourages you to purchase insurance that will cover you and your property. Airbnb's revamped AirCover is free for hosts and typically provides up to $1 million of Airbnb liability coverage and $3 million of damage protection on your. If you're part of Airbnb home-sharing communities and renting your home for extra income, you're one of many. There are about 4 million hosts on Airbnb. Some home-sharing companies offer a form of coverage for hosts. For instance, Airbnb's Host Protection Insurance provides up to $1 million USD for liability. Types of AirBnB insurance available to you: · Accidental Loss Or Damage · Theft By Tenant · Malicious Vandalism · Fire · Storm · Lightning · Flood · Earthquake And. Short-term rental insurance protects your home, condo, or secondary property and the contents inside. It also covers any detached structures, such as a shed. Aware of these risks, Airbnb offers registered hosts the free protection of what it calls Host Protection insurance, which is provided free of charge and may.

File Stock Tax

A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Here's how to calculate it. 40% of the gain or loss is taxed at the short-term capital tax rates. Note: The taxation of options contracts on exchange traded funds (ETF) that hold section. Easy import for investors. Enter your stock sales information and then prepare and e-file your federal taxes on FreeTaxUSA. Free federal premium taxes. Introduction · Pay Capital Gains Tax by 15 December of the same year (for a disposal in December the deadline is 31 January) · File a tax return for CGT by If your account had more than $10 in dividends or more than $20 in sales during the tax year, you received IRS Form DIV or B from Computershare. This. filing the PA Individual Income Tax Return by: Using REV PA Personal Income Tax Treatment of Stock and Securities Received in a Reorganization. All taxpayers must electronically file their capital gains excise tax returns, along with a copy of their federal tax return and all required documentation. The. Most investment income is taxable. But your exact tax rate will depend on several factors, including your tax bracket, the type of investment, and (with. report my investments on my taxes. In the last few years, as some stock file your tax return. You can even connect virtually with a dedicated tax. A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. Here's how to calculate it. 40% of the gain or loss is taxed at the short-term capital tax rates. Note: The taxation of options contracts on exchange traded funds (ETF) that hold section. Easy import for investors. Enter your stock sales information and then prepare and e-file your federal taxes on FreeTaxUSA. Free federal premium taxes. Introduction · Pay Capital Gains Tax by 15 December of the same year (for a disposal in December the deadline is 31 January) · File a tax return for CGT by If your account had more than $10 in dividends or more than $20 in sales during the tax year, you received IRS Form DIV or B from Computershare. This. filing the PA Individual Income Tax Return by: Using REV PA Personal Income Tax Treatment of Stock and Securities Received in a Reorganization. All taxpayers must electronically file their capital gains excise tax returns, along with a copy of their federal tax return and all required documentation. The. Most investment income is taxable. But your exact tax rate will depend on several factors, including your tax bracket, the type of investment, and (with. report my investments on my taxes. In the last few years, as some stock file your tax return. You can even connect virtually with a dedicated tax.

Do I have to file a tax return if I don't owe capital gains tax? No. You are Do I owe Washington capital gains tax on the gain from the sale of qualified. The IRS taxes non-qualified dividends at your regular income tax bracket. The rate on qualified dividends may be 0%, 15%, or 20%, depending on your filing. Meanwhile, long-term gains are taxed at either 0%, 15%, or 20%. The rate you pay is based on your taxable income. Just like with ordinary income tax rates, the. In order to report the sale of stock you must complete Schedule D and Form Top. I bought stock this year. Do I need to report it on my taxes? No. Taxes on employee stock plans can be confusing. Follow the steps outlined in Fidelity's stock plan services hub to understand your tax reporting obligations. FILE YOUR ANNUAL REPORT AND PAY BUSINESS ENTITY TAX. This application is stock market. Questions while filing my Annual Report online – Frequently. The capital stock tax for domestic firms is a property tax imposed on joint-stock associations, limited liability companies, business trusts and entities. You must fill out IRS Form and Schedule D to deduct stock losses on your taxes. Short-term capital losses are calculated against short-term capital gains. Also, long-term gains from equity above Rs 1 lakh annually are taxable at 10%, while short-term gains are taxed at 15%. Deciding whether a specific investment. April 15, The Capital Gains, Dividends and Interest Income Tax Return is due. (Form , PY and NR) The last day to apply for an extension of time to file. When your award vests, you may have taxable ordinary income to report on your tax return. When you sell your stock, you may have capital gains or losses to. Morgan Stanley recognizes that tax reporting for stock plan transactions can be confusing. Understanding the Internal Revenue Service. Outside of a tax-deferred account, you could face a capital gains tax as high as 20% on your profits (rates vary depending on your income — and there could be. Starting with tax year , users who purchase the Classic, Premium, or Self-Employed package can now import their capital transactions using shirunov.ru file. Generally speaking, if you held your shares for one year or less, then profits from the sale will be taxed as short-term capital gains. If you held your shares. If you sold any stocks, bonds, options or other investments in , then you will need to report it on your tax return on Schedule D. TurboTax and other. It's a letter you send to the Internal Revenue Service letting them know you'd like to be taxed on your equity, such as shares of restricted stock. You can electronically import stock transactions (from a brokerage or CSV file), enter them in the TaxAct program, or enter them through Stock Assistant. If you did not pay estimated taxes on your capital gains throughout the year, you may be required to pay a penalty when you file your tax return. If you extend. All capital gains and losses are required to be reported on your tax return. When you prepare and e-file with shirunov.ru, the information you enter will allow.

Should You Look At Apr Or Interest Rate

Don't look only at the APR in determining what loan is the best for you. If the total cost of the loan is critical to you, than APR should be most important. If you're comparing the costs of credit cards, the interest rate and the APR are usually the same because credit cards generally don't require additional fees. An APR is required anytime a bank or lender advertises an interest rate, to help get a more accurate comparison. The interest rate and the APR. Finally, when you're comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual. Some lenders will quote you an interest rate but not mention APR. Or if When Should You Refinance Your Mortgage Loan? Auto Loan Amortization: The. Interest rates and annual percentage rates are two different measures altogether, and should not be used interchangeably. An interest rate helps to calculate. While an interest rate on a loan might seem attractive, the APR accounts for fees and other charges to help borrowers understand the actual cost of their loan. 1. What does each rate mean? The interest rate is the rate of interest you pay annually on the principal loan amount—so a 4% interest rate on a $, What you pay a lender to borrow money as a percentage. · When you borrow money for a home, your interest rate will be based on current market rates and other. Don't look only at the APR in determining what loan is the best for you. If the total cost of the loan is critical to you, than APR should be most important. If you're comparing the costs of credit cards, the interest rate and the APR are usually the same because credit cards generally don't require additional fees. An APR is required anytime a bank or lender advertises an interest rate, to help get a more accurate comparison. The interest rate and the APR. Finally, when you're comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual. Some lenders will quote you an interest rate but not mention APR. Or if When Should You Refinance Your Mortgage Loan? Auto Loan Amortization: The. Interest rates and annual percentage rates are two different measures altogether, and should not be used interchangeably. An interest rate helps to calculate. While an interest rate on a loan might seem attractive, the APR accounts for fees and other charges to help borrowers understand the actual cost of their loan. 1. What does each rate mean? The interest rate is the rate of interest you pay annually on the principal loan amount—so a 4% interest rate on a $, What you pay a lender to borrow money as a percentage. · When you borrow money for a home, your interest rate will be based on current market rates and other.

A lower APR could translate to lower monthly mortgage payments. (You'll see APRs alongside interest rates in today's mortgage rates.) What APR should I get for. Top priority if you plan to keep the mortgage for fewer than five or six years. Most valuable if you're focused on the total cost of the loan for its entire. Any time you see lenders advertise an interest rate, another number called APR is required to be included in the ad. You may not notice it. Mortgage amortization is the method lenders use to divide your payments so your loan is repaid in full when you make your last payment. Here's how it works. The primary difference between APR and interest rate is that the APR reflects the interest rate plus additional costs that may apply to your loan. In that sense. APR = Annual Percentage Rate = Note Rate plus closing costs = True cost of the loan. Say lender A offers you a interest rate (Note Rate) of The catch to using financing is that there is a cost. An annual percentage rate (APR) or interest rate communicates what you will have to pay to use credit. The most common and comparable interest rate is the APR (annual percentage rate), also called nominal APR, an annualized rate which does not include compounding. The point of APR and interest rate is to provide borrowers with a measurement of the total cost of a loan that's easy to understand. With these two rates, you. To determine if an APR is good or not, look at the average rates for people with the same credit score as you. For someone with a good or very good credit score. If you're looking to buy a home or already own, you may be familiar with the terms interest rate and APR. Although they're both used in reference to. If you end up rolling these into your mortgage, your mortgage balance increases, as does your APR. The daily periodic rate, on the other hand, is the interest. interest rate is what you may want to look at when deciding on a loan, because the APR reflects the fees involved. Even when it comes to federal student loans. The most common and comparable interest rate is the APR (annual percentage rate), also called nominal APR, an annualized rate which does not include compounding. In the case of credit cards, APR is usually the same as the interest rate—both of which are especially important if you carry a balance from month to month. If. When looking at APR vs. interest rate in the context of mortgage, auto, personal and other types of loans, the terms APR and interest rate are similar, but not. The point of APR and interest rate is to provide borrowers with a measurement of the total cost of a loan that's easy to understand. With these two rates, you. For example, if you are looking for a conventional finance package such as a PCP, and your credit score is between good and excellent, the APR could fall. The APR is not a one-time charge on your balance each year. Here's a on how credit cards and APRs work: What is credit card interest? Credit card interest. If you're new to the home loan process, you might be surprised to see two different rates on your mortgage agreement: your interest rate and your annual.

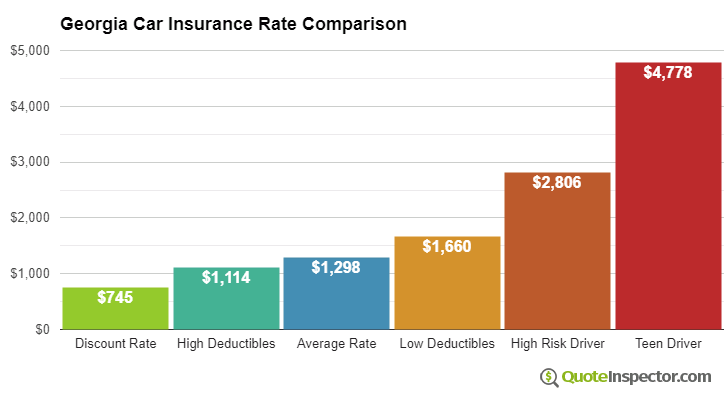

Cheapest Auto Insurance In Ga

Country Financial has the cheapest car insurance for most good drivers in Georgia. · Full coverage refers to a policy that goes beyond the minimum state. GEICO and State Farm are often named as the cheapest and best car insurance companies in Georgia—but while they hold the biggest market shares, they're not. Geico has the lowest rate, on average, for a low-coverage car insurance policy in Georgia. Its sample rate is $1, annually. For comparison's sake, the. We help you compare, find and buy the right car insurance policy at the lowest possible price for you. Start your quote from anywhere online or over the phone. Mercury provides cheap car insurance in Georgia without sacrificing quality. Learn more about what coverage you need and why you should switch to Mercury. You can find cheaper car insurance in Georgia that will give you the coverage you need at a price that won't break the bank. Mercury provides cheap car insurance in Georgia without sacrificing quality. Learn more about what coverage you need and why you should switch to Mercury. Direct Auto specializes in helping people find affordable car insurance coverage, regardless of their history. Give us a call today for a free quote. Cheapest Auto Insurance in Georgia (). Auto-Owners has the cheapest rates in Georgia, at $59 per month for state-minimum liability-only coverage. Country Financial has the cheapest car insurance for most good drivers in Georgia. · Full coverage refers to a policy that goes beyond the minimum state. GEICO and State Farm are often named as the cheapest and best car insurance companies in Georgia—but while they hold the biggest market shares, they're not. Geico has the lowest rate, on average, for a low-coverage car insurance policy in Georgia. Its sample rate is $1, annually. For comparison's sake, the. We help you compare, find and buy the right car insurance policy at the lowest possible price for you. Start your quote from anywhere online or over the phone. Mercury provides cheap car insurance in Georgia without sacrificing quality. Learn more about what coverage you need and why you should switch to Mercury. You can find cheaper car insurance in Georgia that will give you the coverage you need at a price that won't break the bank. Mercury provides cheap car insurance in Georgia without sacrificing quality. Learn more about what coverage you need and why you should switch to Mercury. Direct Auto specializes in helping people find affordable car insurance coverage, regardless of their history. Give us a call today for a free quote. Cheapest Auto Insurance in Georgia (). Auto-Owners has the cheapest rates in Georgia, at $59 per month for state-minimum liability-only coverage.

Browse for the best car insurance policies in Atlanta, GA. Compare quotes from the top 52 car insurance companies in Atlanta, Georgia. Lowest Rates Guaranteed: We specialize in finding you the most affordable auto insurance rates in Georgia. Our goal is to save you money without compromising on. Georgia Farm Bureau offers affordable insurance coverage, including car insurance, truck insurance and so much more. Complete the online quote request. Cheapest recent rates near Atlanta, Georgia. Drivers using Insurify have found quotes as cheap as $48/mo for liability only and $65/mo for full coverage in. Bankrate's analysis found that Mercury, Auto-Owners and Allstate offer some of the lowest rates for car insurance in Georgia. Geico has the lowest rate, on average, for a low-coverage car insurance policy in Georgia. Its sample rate is $1, annually. For comparison's sake, the. We found that Country Financial offers the cheapest annual rate at $ in Georgia. The most expensive annual auto insurance rates are for Progressive which is. Finding cheap car insurance in Georgia has never been simpler. Give us a call at , check us out online for a quick quote or stop by one of our. Discover the best and cheapest car insurance in Georgia with rates starting at $24/month as Geico being the top pick for affordable coverage. We'll help you understand the coverage you need, how much car insurance costs in Georgia, and what best fits you and your budget. Looking for cheap car insurance in Georgia? Freeway Insurance walks you through finding affordable auto insurance, plus discounts. Looking for cheap auto insurance in GA? Whether you're in Savannah or Atlanta, Root's got you covered with a car insurance rate that's fair and affordable. Incredible car insurance savings will be the only thing on your mind when you get a free Georgia auto insurance quote from GEICO. Browse for the best car insurance policies in Atlanta, GA. Compare quotes from the top 52 car insurance companies in Atlanta, Georgia. Georgia requires all drivers to carry a certain amount of liability insurance. The minimum amount of car insurance required in Georgia is: $25, bodily injury. Georgia's average cost is low. For example, the state-required minimum coverage here averages $ annually. Georgia drivers that have a good driving record tend to receive lower insurance rates than drivers who have numerous tickets, an at-fault accident, or a DUI on. RateForce makes it easy to get a free quote for car insurance in Georgia. Compare rates from top insurers and find best coverage for your needs. COUNTRY Financial provides the cheapest minimum coverage auto insurance in Georgia, averaging $ annually. Enter your ZIP code to get started. How much does an auto insurance policy cost in Georgia? According to Bankrate the average annual cost for minimum coverage in Georgia is $ For full coverage.

Collateral For The Loan

:max_bytes(150000):strip_icc()/collateral-loans-315195-v3-5bc4cbf746e0fb002693d842.png)

If a borrower defaults on a loan (due to insolvency or another event), that borrower loses the property pledged as collateral, with the lender then becoming the. Almost anything you own can serve as collateral on a secured personal loan, including your car, bank account savings, and family antiques. A collateral loan is backed by something you own (which is called collateral). Lenders have the right to seize collateral if you can't repay a loan. Collateral is an item of value, such as property or assets, that is pledged by an individual (borrower) in order to guaranty a loan. Collateral is an asset that a lender accepts as security for extending a loan. If the borrower defaults, then the lender may seize the collateral. Collateral loans and asset-based lending are a type of business financing that's based on the value of a certain asset. Collateral is any type of asset a borrower promises to a lender in case a loan cannot be repaid. Learn why collateral is used in a loan agreement. Additional collateral refers to additional assets put up as collateral by a borrower against a debt obligation. If a loan cannot be secured solely by the. In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan. If a borrower defaults on a loan (due to insolvency or another event), that borrower loses the property pledged as collateral, with the lender then becoming the. Almost anything you own can serve as collateral on a secured personal loan, including your car, bank account savings, and family antiques. A collateral loan is backed by something you own (which is called collateral). Lenders have the right to seize collateral if you can't repay a loan. Collateral is an item of value, such as property or assets, that is pledged by an individual (borrower) in order to guaranty a loan. Collateral is an asset that a lender accepts as security for extending a loan. If the borrower defaults, then the lender may seize the collateral. Collateral loans and asset-based lending are a type of business financing that's based on the value of a certain asset. Collateral is any type of asset a borrower promises to a lender in case a loan cannot be repaid. Learn why collateral is used in a loan agreement. Additional collateral refers to additional assets put up as collateral by a borrower against a debt obligation. If a loan cannot be secured solely by the. In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.

The Federal Reserve determines the collateral value of pledged loans as the product of their fair market value estimate and a margin designed to protect the. Like home equity loans, you use your home as collateral for a HELOC. This can put your home at risk if you can't make your payments or they're late. And, if you. Benefits of Collateral Loans with Focus Federal Credit Union · Better Rates and Terms. Collateral loans offer better interest rates and loan terms than. A collateral loan is a type of secured personal loan that is backed by an asset that you own. They are available at many banks, credit unions, and from online. Collateral on a loan backs up your promise to repay the lender with a physical asset. Even if you default on your loan or credit card, the lender can recoup the. A collateral loan is backed by something you own (which is called collateral). Lenders have the right to seize collateral if you can't repay a loan. A Collateral Loan or Collateralized Loan is a type of secured loan in which the borrower pledges an asset or property as collateral to the lender in. Collateral is a tangible or intangible asset pledged to secure a loan. If the borrower stops repaying the loan, the lender can seize and sell the collateral. Like home equity loans, you use your home as collateral for a HELOC. This can put your home at risk if you can't make your payments or they're late. And, if you. The Federal Reserve determines the collateral value of pledged loans as the product of their fair market value estimate and a margin designed to protect the. A collateral loan is secured by something with significant value that your lender may seize if you default. This guide will go over the most common types of collateral and how they affect your small business. Gain Flexibility with a Collateral Loan. Use the power of your savings to secure a great low cost loan. Getting a collateral loan with Torrington Savings Bank. A secured collateral loan requires that the borrower use their assets (such as a car, house or savings account) as collateral to “secure” the loan. The. You may be able to get a collateral loan with bad credit, as the collateral helps to reduce the risk a lender faces in issuing loans. If you default, the lender. What is a Collateralized Loan? A collateralized loan is backed by some form of real estate, equipment, accounts receivables, future credit card payments - all. The good news is basically anything a lender is willing to accept as collateral can serve as collateral, although, most lenders are looking for assets that can. A loan against property financing arrangement includes a loan taken from a financial institution with no restriction on its use by the borrower. The existing. A Collateral Loan from BankFive could be the answer! Sometimes referred to as a Secured Personal Loan or a Passbook Loan, this type of loan allows you to. What is Collateral? · Collateral is an asset pledged by a borrower, to a lender (or a creditor), as security for a loan. · Charges are filed with a public.

Free Tax Income Limit

No application is needed to use this service. For information on volunteering or for the locations of the tax assistance sites, visit the Free Tax Return. The IRS's Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs offer free basic tax preparation to people who need. The Volunteer Income Tax Assistance (VITA) program offers free tax help to people who generally make $60, or less, persons with disabilities, the elderly. MyFreeTaxes · Qualify for free in-person tax filing assistance if your income in was $60, or less. · Qualify for free phone or online filing assistance. Federal Adjusted Gross Income between $17, and $79,; or; Active Duty Military. NOTE: The com Free File website must be accessed through the link. If your total income is less than $64, you likely have one or more cash benefits waiting and tax prep services are at no cost to you. Our tax experts can. If your income is $73, or less, you may be eligible to prepare and file federal income tax returns for free online, using guided tax preparation software. AARP Foundation Tax-Aide provides tax assistance to anyone, free of charge, with a focus on taxpayers who are over 50 and have low to moderate income. If your AGI for was $79, or less, you qualify for free guided tax preparation through the IRS. The $79, limit for IRS Free File applies to both. No application is needed to use this service. For information on volunteering or for the locations of the tax assistance sites, visit the Free Tax Return. The IRS's Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs offer free basic tax preparation to people who need. The Volunteer Income Tax Assistance (VITA) program offers free tax help to people who generally make $60, or less, persons with disabilities, the elderly. MyFreeTaxes · Qualify for free in-person tax filing assistance if your income in was $60, or less. · Qualify for free phone or online filing assistance. Federal Adjusted Gross Income between $17, and $79,; or; Active Duty Military. NOTE: The com Free File website must be accessed through the link. If your total income is less than $64, you likely have one or more cash benefits waiting and tax prep services are at no cost to you. Our tax experts can. If your income is $73, or less, you may be eligible to prepare and file federal income tax returns for free online, using guided tax preparation software. AARP Foundation Tax-Aide provides tax assistance to anyone, free of charge, with a focus on taxpayers who are over 50 and have low to moderate income. If your AGI for was $79, or less, you qualify for free guided tax preparation through the IRS. The $79, limit for IRS Free File applies to both.

Free federal tax filing for those that qualify. Federal filing is $0 - $ if you don't qualify.

If your income is below that threshold, you generally do not need to file a federal tax return. At tax time, not everyone needs to file a tax return before Tax. Depending on your age, filing status, and dependents, for the tax year, the gross income threshold for filing taxes is between $12, and $28, If you. Indy Free Tax Prep: Free tax preparation to individuals and families with a combined household income of $66, or less; The John Boner Neighborhood Centers. Anchor Income Tax Filing Requirements ; Individuals must file if they are: AND gross income is more than: ; Single, $13, ; Married filing joint, $27, Income limitations. Any income. Under $60, Filing years. Time MyFreeTaxes helps people file their federal and state taxes for free, and. tax liability for limitation purposes. Use the rules for filing separate income tax return and even file it electronically for you - free of charge. Eligibility is verified through the Defense Enrollment Eligibility Reporting System. Income Tax Assistance office near you. Talk to a Tax Pro. Call to. The IRS “Free File” program offers free tax prep software to file your own return if you earn $73, a year or less. If you make $73, or more, you can. Free online tax preparation is available until October at shirunov.ru · This option is good for those with less than $65, in income and you need. The College of Business Administration Accounting Department's Volunteer Income Tax Assistance (VITA) Program offers free income tax preparation/assistance to. Partial tax reductions will be received by individuals with net income up to $29, and for families with net income up to $49, The LITR income thresholds. TurboTax's free Canada income tax calculator. Estimate your tax refund or taxes owed, and check federal and provincial tax rates. Tax Credit Amounts ; Basic personal amount. $18, ; Spousal/Equivalent amount. Net income threshold. $18, $20, ; Dependent child amount. $7, ; Senior. Earned Income Tax Credits · Federal EITC. Individuals and families with incomes up to $63, with a valid Social Security number may be eligible for up to. Limit one per customer. May be modified or discontinued at any Tax Pro referrals must be submitted prior to a candidate's enrollment in the Income Tax. MyFreeTaxes helps people file their federal and state taxes for free, and it's brought to you by United Way. File your state or federal tax return for free depending on your income & other factors. See purple circle with a white dollar bill inside Maximum Refund. These tools will guide you through filling out your tax return. If your income is more than $73,, you can prepare and file your taxes for free using IRS Free. File your federal & state taxes for free · Ideal for. W-2 income · Maximize tax credits for dependents · Get the green light to file · Get your maximum tax. If you choose this option, you should know how to prepare your own tax return. Please note, it is the only IRS Free File option available for taxpayers whose.

How Do Bank Stocks Perform During Inflation

Some businesses can thrive during inflation, when prices are rising. Banks, for example, earn more money as interest rates rise and profit off. performing sector year to date. Since utility stocks often are seen as proxies for bonds — which often perform poorly during periods of rising inflation and. One of the most widely accepted ways to maintain value is to have a widely diversified portfolio where commodities, bonds, and inflation-protected investments. To that end, when inflation is rising, investment managers may invest in companies such as a utility. Or it could be a company manufacturing an essential. Inflation is a sustained increase in prices of goods and services, which can negatively impact purchasing power and lead to tough financial decisions for. The principal (called par value or face value) of a TIPS goes up with inflation and down with deflation. When a TIPS matures, you get either the increased . During periods of high inflation, shares associated with larger current cash flows are more valuable than growth stocks that promise more distant returns. This. TIPS are a type of Treasury security whose principal value is indexed to inflation. When inflation rises, the TIPS' principal value is adjusted up. If there's. Here's where experts recommend you should put your money during an inflation surge · 1. TIPS · 2. Cash · 3. Short-term bonds · 4. Stocks · 5. Real estate · 6. Gold · 7. Some businesses can thrive during inflation, when prices are rising. Banks, for example, earn more money as interest rates rise and profit off. performing sector year to date. Since utility stocks often are seen as proxies for bonds — which often perform poorly during periods of rising inflation and. One of the most widely accepted ways to maintain value is to have a widely diversified portfolio where commodities, bonds, and inflation-protected investments. To that end, when inflation is rising, investment managers may invest in companies such as a utility. Or it could be a company manufacturing an essential. Inflation is a sustained increase in prices of goods and services, which can negatively impact purchasing power and lead to tough financial decisions for. The principal (called par value or face value) of a TIPS goes up with inflation and down with deflation. When a TIPS matures, you get either the increased . During periods of high inflation, shares associated with larger current cash flows are more valuable than growth stocks that promise more distant returns. This. TIPS are a type of Treasury security whose principal value is indexed to inflation. When inflation rises, the TIPS' principal value is adjusted up. If there's. Here's where experts recommend you should put your money during an inflation surge · 1. TIPS · 2. Cash · 3. Short-term bonds · 4. Stocks · 5. Real estate · 6. Gold · 7.

Riding the wave in terms of timing and amount. When interest rates fall, banks take longer to reduce your loan rates. When rates increase, they. Central banks have to either accept higher inflation or destroy demand to squeeze wages and prices to rein in inflation. Bringing inflation down to central bank. Her individual stocks are Microsoft and OneSavings Bank. Marianna said: “My make better financial decisions for themselves. We do this by giving. Asset price inflation refers to the prices and valuations of financial assets, like stocks, bonds, real estate, gold, fine art, and collectibles increasing over. If interest rates go down, the existing loans the bank owns become more valuable. They also don't have to pay as much to depositors. Also, if. inflationary environments. We found that convertible securities could offer benefits that stocks and bonds could not, providing a powerful tool for. When you buy a bond, you are essentially lending the government or company money which they promise to repay after a set period of time, often with a set amount. While inflation affects individual companies and industries differently, the S&P over the long term has historically provided positive real returns — or the. In a time of high inflation when interest rates are hitting record-highs and seemingly stable banks are collapsing, it can be difficult to know what to do. The conditions are somewhat unique this time, as the Fed is not seeking to address a collapsing economy or arrest a seizing financial system. Put differently. For example, the. European Central Bank targets an inflation rate of 2% over the medium term. By adjusting the interest rates paid by banks (when banks borrow. In times of inflation, it may be important for investors to consider being more selective within their equities. Value stocks are a great place to start, as. First, cyclically geared value stocks with more sensitivity to economic growth tend to outperform relative to the broader market. In addition, P/E multiples. performing sector year to date. Since utility stocks often are seen as proxies for bonds — which often perform poorly during periods of rising inflation and. In a time of high inflation when interest rates are hitting record-highs and seemingly stable banks are collapsing, it can be difficult to know what to do. Interest rate is the cost of borrowing. It is closely related to inflation. To stabilise inflation, central banks tend to adjust interest rates from time to. Unfortunately, stocks are also affected by inflation. Usually, you'd have a positive correlation between stock prices and bond prices. If one goes up, so does. Central banks use monetary policy to manage economic fluctuations and achieve price stability, which means that inflation is low and stable. Central banks in. This could mean lower prices and, ultimately, a slower rate of growth for stocks with high dividend yields. When inflation lowers, public company earnings do. In other words, the equity market will (generally) rise when CPI numbers are small because low inflation leads to low interest rates, which are good for.

1 2 3 4