Outrage Over Proposed Increase of French Retirement Age to 66

A recent recommendation by government advisers to elevate the retirement age in France to 66 has ignited strong condemnation from labor unions and opposition groups, just two years after President Macron implemented a controversial rise to 64 amidst widespread protests and strikes.

With memories of the intense street demonstrations and strikes from the previous year still vivid, unions and left-wing opposition parties reacted furiously to a report from the Council on Retirement Policy. The report claimed that France’s most expensive pension system would be unsustainable unless the retirement age is raised to 66 by the year 2045.

“This is a blatant provocation. Workers in France have already faced severe consequences. Demanding that they work longer is absolutely unacceptable and will meet with strong resistance,” said Laurent Berger, the leader of the moderate CFDT union.

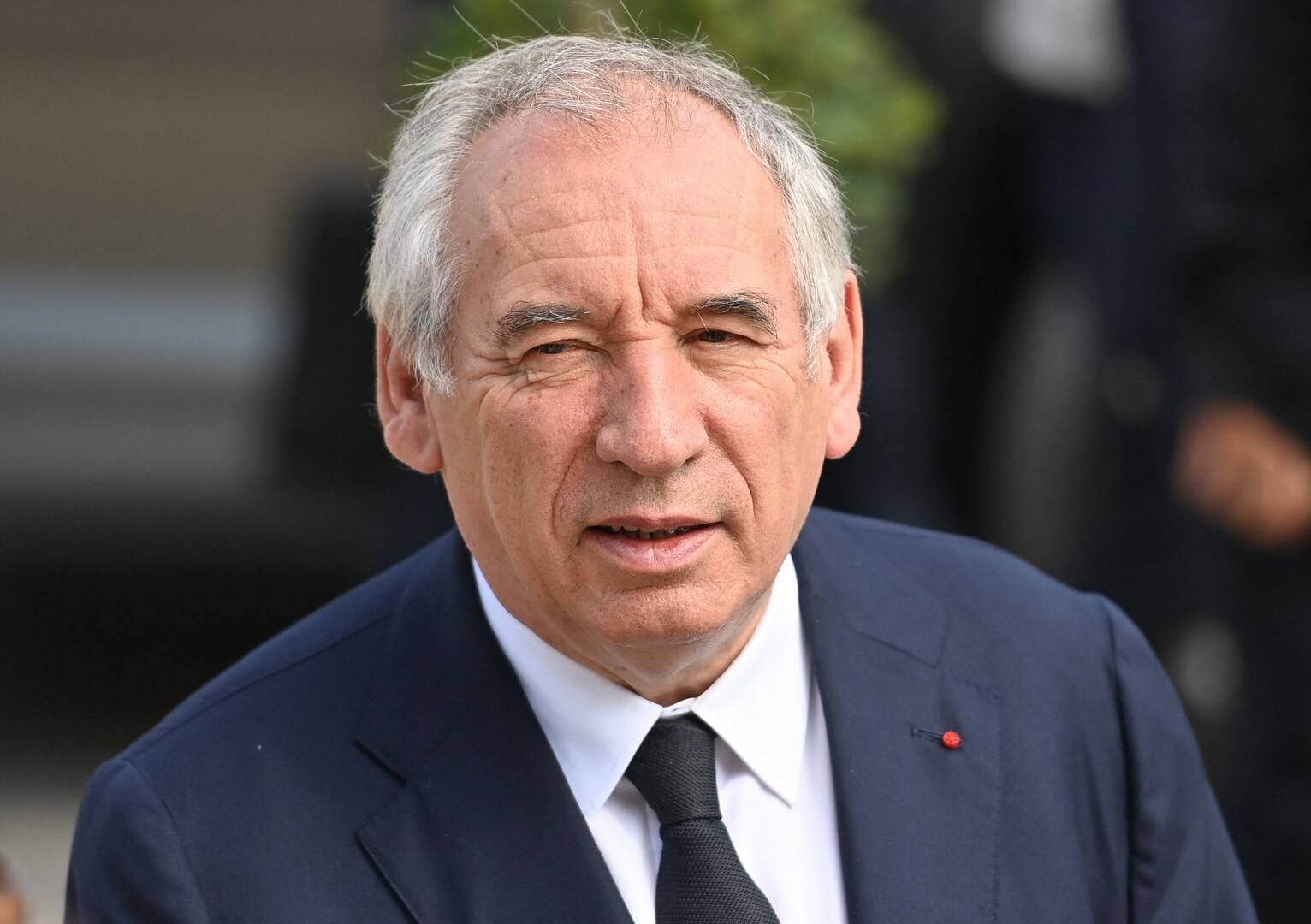

Sophie Binet, the head of the militant CGT union, charged the minority government, headed by François Bayrou, with “playing with fire.”

“Should they attempt to raise the retirement age again, it will result in a social explosion. We will not allow them to dismantle our hard-fought rights,” she warned.

Left-leaning opposition parties expressed disbelief, noting that polls indicate over 60 percent of the public views the increase to 64, which will be fully implemented by 2030, as unjustifiable.

“This is a declaration of war on the French populace. Macron and his advisors aim to convert retirement into a privilege accessible only to the wealthy. If they press on, we will paralyze the country,” declared Jean-Luc Mélenchon, head of the radical Unbowed France party.

The Socialist party, led by Olivier Faure, also issued harsh critiques.

“The government is employing fear tactics and inflated statistics to justify yet another assault on ordinary citizens. We will fiercely oppose this injustice,” Faure stated.

The council’s report, which was leaked prior to its official launch, warned that without further increases in the retirement age, France’s pension deficit could soar to €15 billion by 2035. It highlighted that currently, pensions account for 25% of French public spending, a share that continues to grow despite recent reforms.

In comparison, Germany is raising its retirement age to 67, while in the UK it is set to increase to 68 and Denmark plans to elevate it to 70 by 2040. However, many French citizens believe that their country’s social model—which is backed by some of the world’s highest taxes—should shield their pension system from the effects of increased life expectancy.

Macron’s centrist bloc faced a setback in snap parliamentary elections last summer, largely because the government enacted the unwelcomed pension reforms without legislative approval.

This resulted in an inconclusive election that led to the downfall of the first minority government in December.

Since then, Bayrou, a centrist ally of Macron who assembled a fragile coalition in December, has engaged in discussions with unions in an attempt to mitigate ongoing discontent surrounding the reforms.

Unions continue to demand a return to an age of 62 for at least some workers, but Bayrou has rejected this proposal, leading to warnings of renewed protests and strikes. The far-right National Rally also vows to revert the retirement age to 62 should it secure victory in the 2027 presidential election. Marine Le Pen, currently unable to run due to a conviction related to embezzling EU funds, is appealing her sentence.

Only Macron’s centrist bloc and the center-right Republicans are in favor of maintaining the increased retirement age.

Pension expenses, comprising 14% of French GDP, are significantly impacting the government’s aim to reduce at least €40 billion from the following year’s budget in an effort to decrease this year’s 4.6% GDP deficit.

Growing tension surrounds leaked proposals that could increase taxes for affluent pensioners, with approximately half a million retirees expected to become subject to income tax if the longstanding 10 percent allowance on pension income is eliminated.

Post Comment